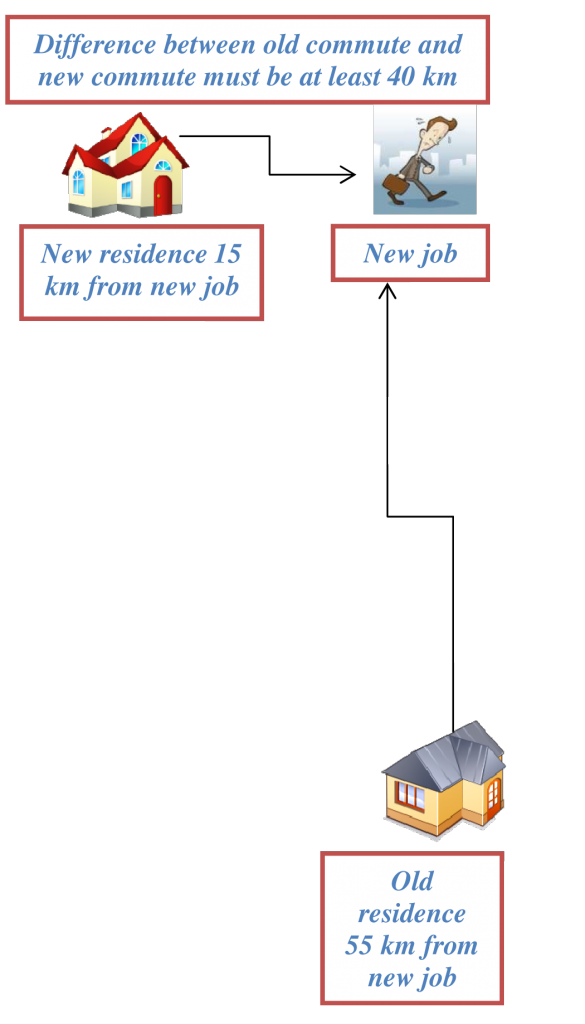

You may claim the expenses to move yourself and your family, including the costs to move your personal items. To qualify, your new home must be at least 40 kilometers (by the shortest usual public route) closer to the new place of work.

Deductible Expenses

Transportation and Storage Costs (while in transit):

- Hauling your personal items to the new location

- Parking

- Storing your personal items

- Insurance

Travel Expenses:

- Vehicle expenses

- Accommodations for up to 15 days near your old or new residence

- Meals while in transit

- You may claim vehicle and meals expenses using the simplified method (SEE BELOW)

Costs Related To Your Old Residence:

- Any lease cancellation fees (does not include rent)

- If you sold your old house, you may deduct advertising costs, legal or notary fees, real estate commissions and any mortgage penalties

- If you are attempting to sell your old house but cannot sell it before the move, the expenses to maintain that house may be deducted (i.e. utilities, property tax, interest, etc.) to a maximum of $5,000. These costs may be deducted in the following year when the house is sold

Costs Related To Your New Residence:

- If you have purchased a new home, you may deduct the costs related to your new home purchase including land transfer taxes, notary or legal fees and registration (note that the costs of purchasing are not deductible when you rented prior to the move)

Incidentals:

- You may claim expenses such as driver’s license change-over, license plates replacement, utility connections / disconnections

- Costs for job hunting, house hunting trips to the new location or renovations required for your previous house or rental unit are not deductible.

Simplified Method:

- Under this method, a per-kilometre rate for travel and meal expenses can be used. Although you do not need to keep detailed receipts for actual expenses, you may still be asked to provide some documentation to support your claim. You should be able to substantiate the length of the trip required. CRA requires that the shortest possible route on major roads be used in the calculation.

You cannot use the simplified method to calculate expenses if you deduct mileage for business or employment use - The 2023 rates were: (NOTE: 2024 rates will be available in early 2025)

- $23 per meal, up to 3 meals per day of travel (maximum $69 per day) per person

- $0.59 per km of travel in Ontario

Other Considerations:

- Expenses may only be deducted from employment or self-employed income earned at the new location

- If expenses exceed income from your new employment (because you moved close to the end of the year), you can carry-forward those expenses to deduct from income in the following year

- To be eligible for this deduction, your employment or self-employment income from the previous location must stop

- If your employer has reimbursed you for moving expenses, you may still claim expenses that exceed the reimbursement. Typically, your employer would include the reimbursed amount on your T4 as a taxable benefit, in which case the moving expenses may be claimed in full

- HST and other sales taxes may be included in expenses except in the case of a new home purchase

Students:

- You can claim eligible moving expenses if you moved to study courses as a student in full-time attendance at a university, college or other post-secondary educational institution. However, you can only deduct these expenses from the part of your scholarships, fellowships, bursaries, certain prizes and research grants that are required to be included in your income.