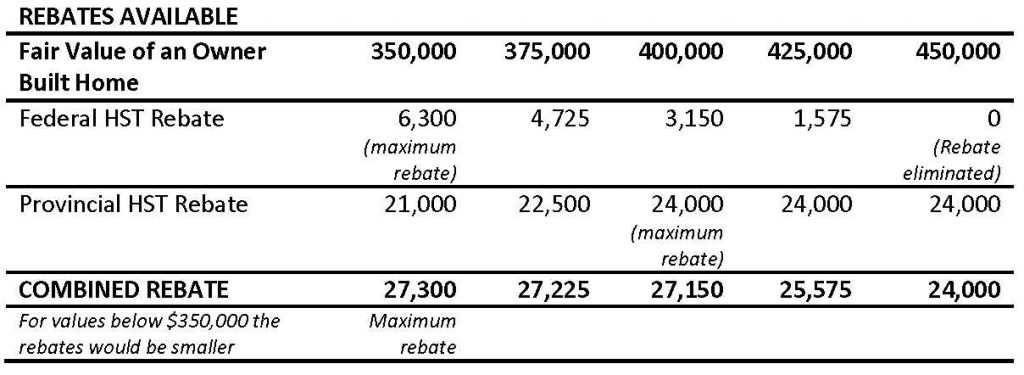

Did you know that you can recover some of the HST charged on newly constructed and substantially renovated homes? You could receive a rebate of 36% on the federal portion of HST and 75% on the provincial portion of HST when you buy, build or renovate your home.

When you purchase a newly constructed home, the rebates are usually factored in the selling price. However in some instances, such as rental property purchases, owner-built homes and substantially renovated homes, you must apply for these rebates yourself.

These rebates are significant. See the table below and contact our office for further information.

Does Your Home Qualify?

- Did you a purchase a newly constructed home?

- Did you build or have a contractor build a new home?

- Did you substantially renovate or build a major addition to your existing home?

- Did you build or buy a home to be leased by a tenant?